Tag: HX

84 Posts

Wargames

The Wasp that Refused to Die

One Last Hurrah – Finnish Media visits an HX-contender

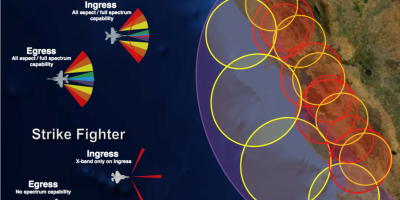

Boeing Refusing to Let New Fighters Steal(th) the Show

Swiss decision rolls in F-35’s favour

Lifting the Fog

Cruise Missiles Flying over your Head

The Further Adventures of the F-35 (and the Super Hornet)