Tag: Saab

13 Posts

Survivability of a Finnish AEW&C

GlobalEye for HX

Baltic Sea, Blog Posts, Finland, Naval, Sweden

Combat Boats and Landing Craft

Saab to supply 9LV for Pohjanmaa-class

Schrödinger’s Griffin

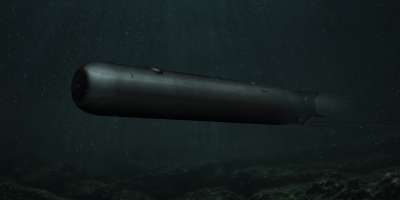

Torped 47 – Steel fishes back into Finnish service

RBS15 – on the road to the Next Generation

Saab Bound for Naval Grand Slam?